Feel Better Sooner

Quality Urgent Care the Moment You Need It

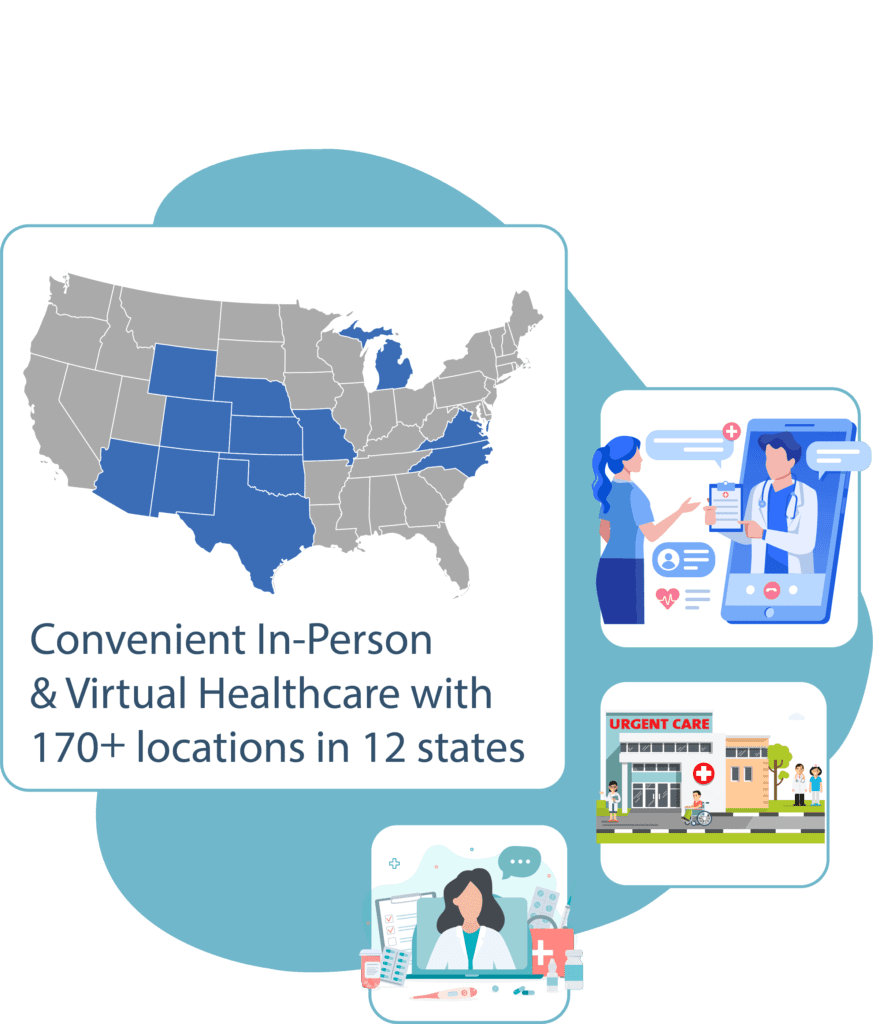

Our walk-in clinics provide quality medical care the day you need it – no appointment necessary. With over 170+ locations, treating your illness or injury is easy and accessible at NextCare.

In-Person & Virtual Care

At NextCare, we strive to be available for our patients and make the process of an urgent care visit as simple and seamless as we can. Our Online Check-In system allows you to book your time, skip the line, and show up to the clinic when your room is ready. If you want to skip the clinic entirely, our Virtual Care program can put you in contact with a provider quickly and safely from the comfort of your own home.

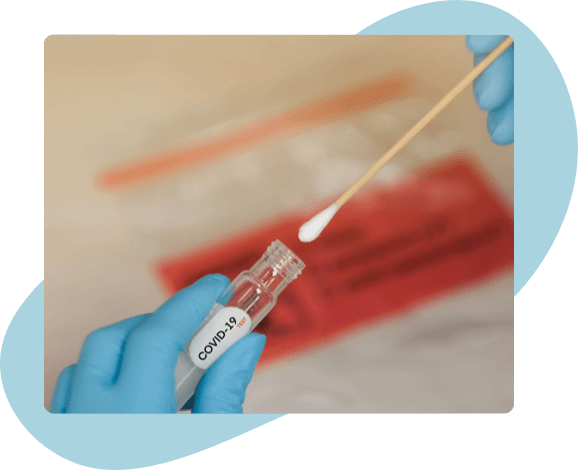

COVID-19

We are now offering rapid COVID-19 testing and antibody testing. If you are experiencing COVID-19 symptoms, we can provide your test results in as few as 5 minutes.

You’re Covered

NextCare accepts most major health insurance plans and providers to ensure you get quality care at a cost that fits within your budget. If you are uninsured or have a high deductible health care plan, we also offer medical discount programs to ensure that feeling better is accessible to any and all patients.

Our Urgent Care Services

Did you know 80% of emergency room visits can be treated at NextCare Urgent Care?

See What Our Patients Are Saying

Year-Round Health Resources

We’re here to help whenever you feel ill, but keeping you healthy is our priority. From seasonal allergies to burn identification and treatments, we have the resources you need to live your healthiest life.